- E-Banking

- Individual

- Biznes

Digital Banking Channels

E-Banking

Make your banking experience easier through e-Banking

E-Banking is an online system for carrying out banking services. It saves time, it is safe and very efficient for people who can not visit the bank to carry out a certain service.

It provides access 24 hours a day, 7 days a week.

This service can be activated here or in your nearest TEB Bank branch.

Access and use

At the point of application for this product you will receive an SMS in your phone number which you have registered in the bank. The SMS contains the single use PIN which enables you to log in to e-Banking. The PIN that arrives via SMS is only valid for 3 minutes and when that time expires, the PIN is no longer valid.

Note: The customer’s access to e-Banking will be blocked in those cases when the customer enters the wrong Password or PIN three times in a row. In that case the customer must apply for a new password/PIN by completing a modification form at the branch or through IVR – Automatic Calls in the Call Center on 038-230 000. The same process and conditions apply to those customers who have lost their password.

For more information, visit the nearest TEB branch, email us at info@teb-kos.com or contact us at our Call Center 038/230000.

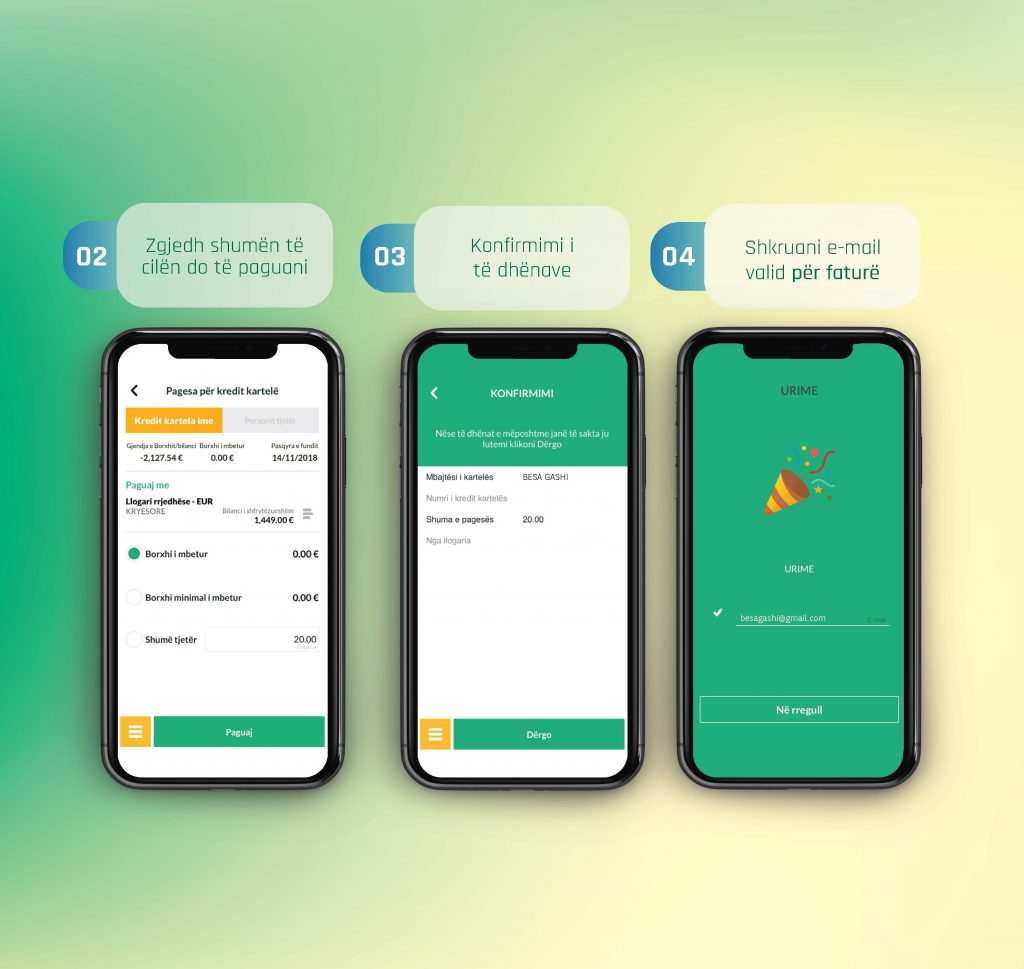

TEB Mobile

Banking services anytime and anywhere!

With TEB Bank TEBMobile applications, you can easily access Online Banking information via your smart phone or tablet, simply download the application to start exploring.

Teb Mobile is available for iOS and Android systems and can be downloaded for free in the App Store & Play Store and is available in two languages: English and Albanian.

Download the TEB Mobile Banking Application:

To access the TEB Mobile application, you must have activated the E-banking product, where you will be provided with a user ID and password.

First log in to the Teb Mobile application and enter the E-banking user ID and password. You will then receive a message regarding PIN code for accessing TEB Mobile.

Once you have accessed through PIN received via SMS, you must create a new personal PIN (one of these: numeric PIN, fingerprint PIN, or draw PIN).

* If you want to use your fingerprint PIN, it must be defined on your device.

The following services can be provided through TEBMobile:

Benefits for TEBMobile users:

With TEBMobile, you can easily access Online Banking information, including features like:

Safe and easy access

Log in using your personal ID and password or use any of the secure authentication features we offer, such as Face ID, fingerprint identification, or a unique 4-digit passcode.

Through TEBMobile by managing your account 24/7, you have the option to see or identify if you have any suspicious activity. With the secure and convenient benefits of TEBMobile you can use your online banking information and functionality with a flick of your finger.

Note: When you first log in to the TebMobile application after creating a numeric PIN, fingerprint PIN, or drawn PIN, the following question will appear on the screen:

Do you want to use the “smart key” to access e-Banking?

If users choose the “smart key” to access e-Banking, they will no longer receive SMS. In order to switch to SMS again, users must first reactivate the “smart key” and then they must not select the”smart key” to access e-Banking.

Note: The customer’s access to TebMobile will be blocked in those cases when the customer enters the wrong Password or PIN three times in a row. The customer will then need to apply for a new password/PIN by completing a modification form at the branch or through the Call Center. The same conditions apply to those customers who have lost their password.

For more information, visit the nearest TEB branch, email us at info@teb-kos.com or contact us at our Call Center 038/230000

The customer’s access to TebMobile will be blocked in those cases when the customer enters the wrong Password or PIN three times in a row. The customer will then need to apply for a new password/PIN via automatic calls to the Call Center or branch by filling out a modification form. The same conditions apply to those customers who have lost their password.

ATM

TEB Bank offers the most sophisticated ATM’s in our market.

To provide 24/7 access to your current account and to StarCard, TEB has invested and expanded the network to 81 ATM’s. You can withdraw or deposit throughout Kosovo quickly and safely, avoiding waiting in line at the branch.

TEB Bank ATM’s provide various services, such as:

• Withdrawal of cash

• Withdrawal of coins

• Deposit of cash

• Transfers

• Repayment of Starcard debt

• Checking your balance

• Changing card PIN

• ATM security

• Add your phone number

Through our ATM’s, we also provide services to card holders of other banks if they are branded with VISA, VISA Electron, PLUS and MasterCard, Maestro and Cirrus.

Cash Withdrawals:

You may withdraw € 10, € 20, € 50 and € 100 notes from TEB Bank ATM’s.

While for the first time in Kosovo you can now also withdraw €1.00 in coins. Withdrawals with TEB Debit cards are free of charge, while for withdrawals with StarCard a fee is applied as per the Price List in force (published on the TEB bank website www.teb-kos.com).

Cash deposit:

TEB Bank has ATMs where you may deposit money.

• Deposit is done in 5€, 10€, 20€, 50€ and 100€. notes

• Maximum deposit is 40 notes at one time, the limit per transaction is 2,000€, while the daily limit is up to 5,995 € for individuals while for businesses 9,695 €.

• Notes that are crushed, folded or written on shall not be accepted.

Transfers:

You may perform various transfers through TEB Bank ATM’s, such as:

• Intra bank transfers (TEB)

• Quick intra bank transfers

• Quick transfers to local banks

With quick transfers, you must have previously registered beneficiaries. Beneficiary registration is done in advance at the branch or through e-banking.

Starcard debt repayment:

You can pay your or other persons Starcard debt, in two ways: transfer from current account or depositing money (in ATM’s where depositing is provided).

The payment method through cash deposit:

• If minimum payment of Starcard debt is completed, then the ATM does not return change in coins, but the change is credited to account.

• If total Starcard debt is repaid then the ATM returns a change in coins in the amount of 1 to 9.99 €.x

Checking the balance:

You can view your current account balance and Starcard balance in TEB Bank ATM’s, the statement can also be printed out.

Changing the card PIN:

You may change the debit card and Starcard PIN in TEB Bank ATM’s by entering the old PIN and then replacing it with the new PIN.

ATM security:

TEB Bank ATM’s offer high security for performing services.

ATM’s have equipment which prevent obtaining card data and are monitored 24/7 by security cameras.

POS Terminals

Increase your turnover through a TEB Point of Sale (POS)

The evolution of banking has introduced new methods of payments that reduce the need for cash in daily transactions. Point of Sale (POS) is a banking point at your store that allows customers to pay with a TEB debit or credit card.

By installing a POS, you will become part of the biggest POS network in Kosovo and vastly increase your access to customers and their access to the goods and services you offer.

POS Terminal TEB Kosovo

The advantage of having a Point of Sale lies in the potential to increase sales as a huge number of customers now use the market-leading TEB StarCard. By becoming part of TEB Point of Sale (POS) network, you will participate in the numerous campaigns organized throughout the year that will channel clients to your business and increase your sales.

TEB was the first bank to offer Point of Sale (POS) in GPRS technology which minimizes operational inconveniences in serving customers.

You can easily access movements in your POS account through Business e-Banking or through our Call Center Services on 038 / 230-000.

SMS Banking

Your account in your pocket

You do not want to go to a branch. You do not have time to contact the Call Center. You do not have internet access. But you still want to manage your banking 24/7.

TEB is there to think about you.

Types of SMS Banking:

– SMS Inquiry

– SMS Notifcation

– SMS Top Up

– SMS Ipko digital TV & Internet

– SMS Kesco invoice payments

SMS Inquiry

Send an SMS inquiry and you will receive information on all your account balances in all currencies in your:

• Current account;

• Savings account;

• Flexi Account;

• If you have accounts in GB pounds and Swiss francs, the SMS will only show the sum of your account balances

You can also receive information on:

• Currency exchange rates

• Credit Card used limit (Starcard, Premium Card or She Card) and total balance.

After you visit our Branch and register for the service, you can access all above information by sending and SMS to 50001 with below information.

• BALANCE – for account information

• CURRENCY – for currency exchange information.

• STARCARD – for Starcard limit used and outstanding balance

SMS Notification

If you want to monitor the transactions in your account, we will inform you by SMS for each incoming or outgoing transaction over 10€, or you can set your minimum transaction amount.

You can also have your Starcard card balance in your pocket with the service – an SMS Notification.

Through SMS Notifications you will receive:

• Transfers,

• Loan installment payment date,

• Credit Card Payment Cycle

SMS Top Up

For all prepaid mobile users, TEB offers SMS Top Up, a service through which you can top up your phone or that of your family and friends – all with a single SMS to 50001.

TEB SMS Top Up is a product of TEB that was developed in cooperation with mobile telephone operators in Kosovo.

TEB SMS Top Up is an electronic way to top up your phone at any time; 24 hours a day, 7 days a week. This is an easy and convenient way to top up your phone via SMS.

Customers can authorize other people to top up their phones from their current account or Starcard by setting a daily limit.

If the client sends an SMS from VALA operator then they will top up the number of this operator, while if the client sends an SMS from the IPKO operator they will top up the number of this operator. It is also possible to top up, for example: IPKO’s number by sending an SMS from Vala or vice versa.

IPKO Digital TV & Internet

In cooperation with the telecommunications service provider “IPKO”, TEB offers all the convenient ways for its customers to top up their monthly package services for internet, TV or fixed telephone line. You can use IPKO top-up services at any time from any place with a single SMS. Payment will be debited from your TEB checking account and the service will be activated immediately. And there is more. You can use this service to top up IPKO accounts of friends or family.

How it works: depending on the account and package you want to top up, simply send an SMS to 50001.

TV – to fill Digital TV. For example: (ipkoyourusernametv, ie ipkoemrimbiemritv, example ipkokobesagashitv or depending on the name how you open your IPKO account)

Duotv – to fill the duo package with TV and internet. For example: (ipkoyourusernameduotv)

Duofix – to fill the duo package with Internet and Landline. For example: (ipkoyourusernameduofix)

To activate IPKO Top Up, visit your nearest TEB branch.

KESCO invoice payments

From now on, payment of electric bills (KESCO) can be made by sending only one SMS message from mobile phones.

Customers of TEB Bank from now on can make regular monthly payments of electricity bills only by sending an SMS from their mobile phones from all national operators.

How it works: Just send an SMS from your phone number registered with the Bank, to the number 50001, indicating the reference number of the electric bill (KESCO) and the amount you want to pay.

This method of payment also offers a new payment option, which facilitates this obligation for citizens.

To benefit from this service, customers must register in one of the nearest branches of TEB Bank.

Reset PIN / password

The customer’s access to TebMobile will be blocked in those cases when the customer enters the wrong Password or PIN three times in a row. The client will then need to apply for the new password / PIN via TEB Mobile application, automatic calls to the Call Center or branch by filling out a modification form. The same conditions apply to those customers who have lost their password.

To reset the password via TebMobile you must follow the instructions:

To reset the password via automatic calls to the Call Center you must follow the instructions:

1) Select the language in which you want to perform this service,

2) Press the number 3 for reset,

3) You will be asked for your personal ID number (the system will read the last 4 numbers of your card),

4) You must enter the PIN of your card number,

5) Confirm your phone number.