- E-Banking

- Individual

- Biznes

Loading...

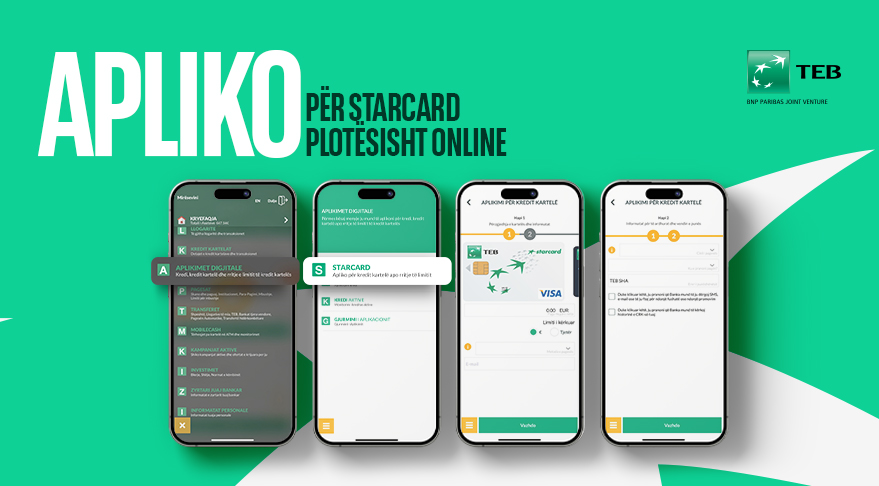

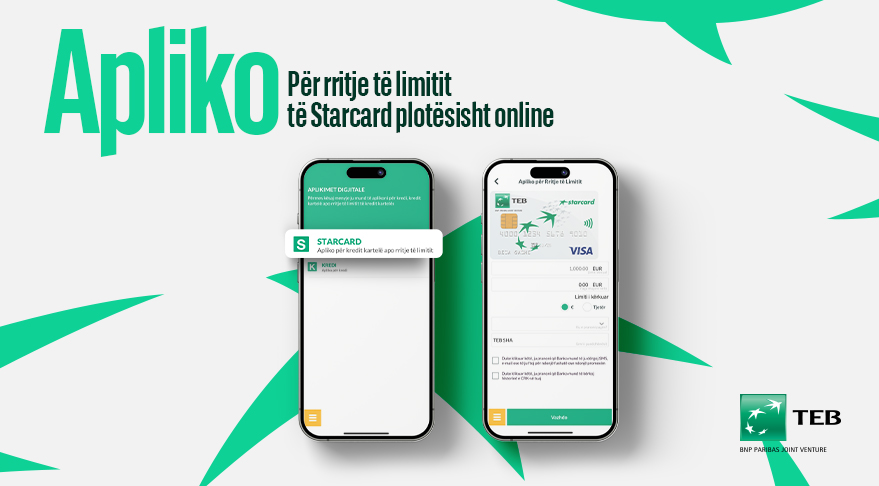

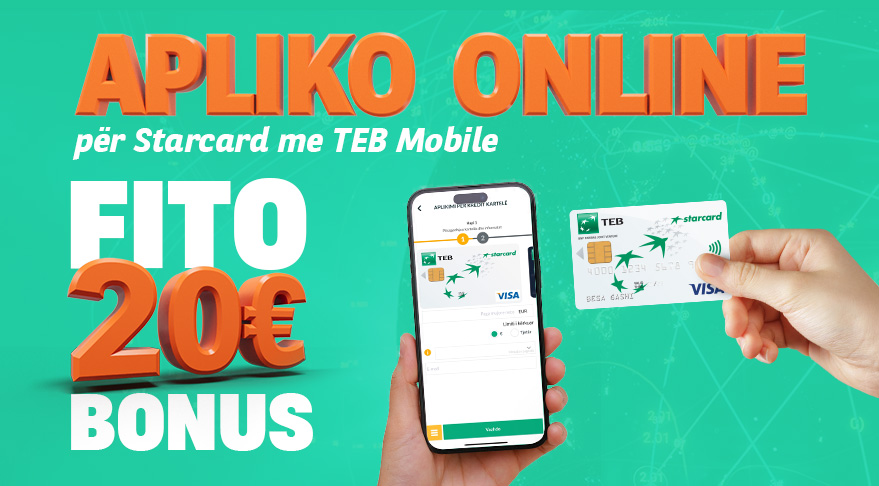

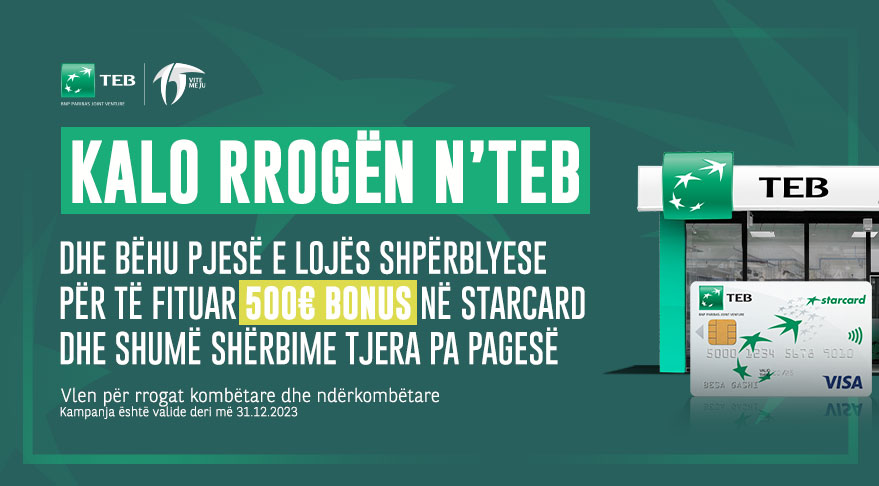

Starcard

APPLY

APPLY

Starcard is the product that has truly revolutionized consumer spending in Kosovo. This credit card offers a..

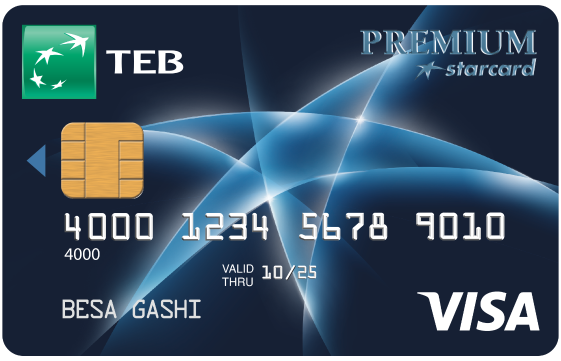

read morePremium Starcard

APPLY

APPLY

With Starcard Premium in your pocket every shopping experience is unique. Premium Starcard offers you

read moreShe Card

APPLY

APPLY

Is a unique card in the market, only dedicated to women who can purchase in installments without interes

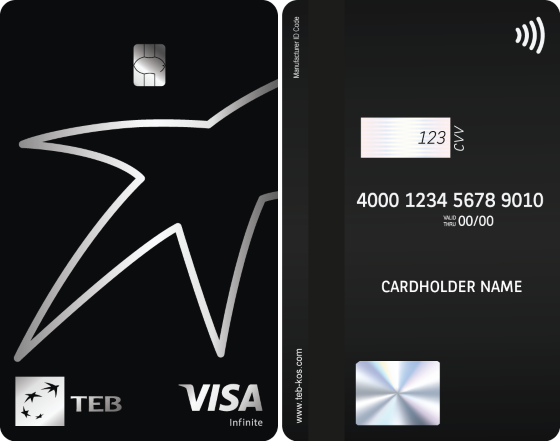

read moreVisa Infinite

The Visa Infinite Card is the highest level of Credit Card in Kosovo offered by banks throughout the region.

moreNews and Publications

September 5, 2025

TEB Bank becomes General Sp...

TEB Bank is pleased to announce its support as General Sponsor of the 17th edition of PriFest, Pristina International Film...

Read more

September 5, 2025

TEB Bank becomes General Sp...

TEB Bank is pleased to announce its support as General Sponsor of the 17th edition of PriFest, Pristina International Film...

Read more

Properties for sale

More

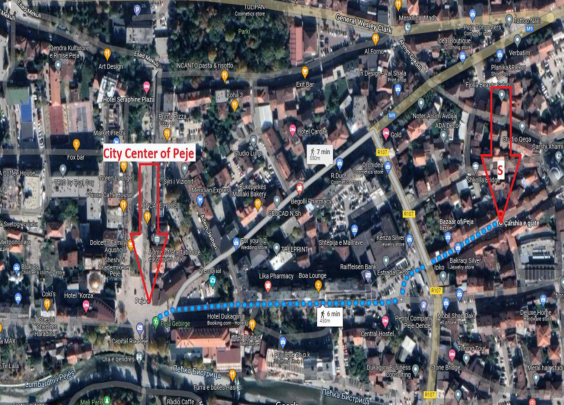

Paluajtshmëria 104

Shiko PDF-in

Paluajtshmëria 52

Paluajtshmëria 52

Paluajtshmëria 7

Paluajtshmëria 7